This translates to RMB 2420 per month. The net PCB should be 28 of his or her salary for a non-resident employee in Malaysia.

How To Calculate Monthly Pcb Income Tax In Malaysia Mkyong Com

Let us understand the formula with an illustration.

. Brad Little vetoed a bill to keep this formula intact through 2023-24. N Total number of years. Shall be deemed to be salary or wages income taxable at the rate declared by Section 1 of the Income Tax Salary or Wages Tax Rates Act 1979.

FV Future Value The amount to be received after maturity P Annual installments by the investor. Users can further customise the computation for allowance overtime and shift calculation with a built-in formula builder. This best payroll software in Malaysia can handle multiple company transactions at a time.

2A 65 66 Income referred to in Subsection 1 except where it relates to income covered by Subsection 2 to the extent it is a distribution from an authorised superannuation fund being a prescribed sum and. The rates given apply for a 12-month taxation year ending on 31 December 2022 and do not take into account provincial tax holidays which. Total salary is RM 5000 each month.

Here the amount of gratuity that one gets depends on the half months salary for each completed service year. 1 Normal Remuneration Normal remuneration is a fixed monthly salary. The 1530 calculation represents 15 days out of working days of a month which are 30.

Net PCB RM 500000 x 28. The average monthly salary in Shanghai which serves as a basis for the computation of the severance pay and social insurance was increased by 52 from the previous minimum wage. The contribution percentage is 025 of the staff members monthly wage.

For part-time employees the hourly. 1 Computerised calculation for Normal Remuneration 2 Computerised calculation for Additional Remuneration 3 Computerised calculation for Returning Expert Program REP 4 Computerised calculation for. For precise calculations use SSGs SDL calculator.

I The rate of interest periodically. 00 x 28 An example. How to Pay the SDL.

A resident employees PCB calculation are categorised into four formulas. Having different types of payment modes for your employees is not a problem as it can calculate hourly daily and monthly salaries. Total monthly remuneration RM 500000.

The state began using an enrollment-based formula during the COVID-19 pandemic. Generally income is allocated to a province or territory by using a two-factor formula based on gross revenue and on salaries and wages. The total number of service years is rounded down.

The salary last drawn carries the basic salary commission on the sale and dearness allowance. Weeks later the State Board approved a temporary rule to continue enrollment-based funding through the 2023 legislative session. The following formula is used to calculate PPF account amount.

The employer may change the category of remuneration based on the approval from the IRBM. Effectively with the increase the average monthly salary in Shanghai is now RMB 7172. RM 5000 for the net PCB.

The SDL calculation formula is as follows. FV P 1 i n 1 i Here is the elaboration. Provincial and territorial income taxes are not deductible for federal income tax purposes.

Once the government notifies the interest rate for any Financial Year and the current year comes to an end the EPFO calculates the month wise closing balance. Formula of PF Calculation. The minimum SDL levy is 2 SGD while the maximum is 1125 SGD.

MTD formula are categorised into four 4 formulas. ID For the purposes of payment of sick leave under section 60F the calculation of the ordinary rate of pay of an employee employed on a daily rate of pay or on piece rates under subsection 1C shall take account only of the basic pay the employee receives or the rate per piece he is paid for work done in a day under the contract of service. For a non-resident employee in Malaysia the net PCB should be 28 of his or her salary.

Wages up to 800 SGD month have a 2 SGD levy.

Personal Break Even Rate Hourly Rate Salary Required

Overtime Calculator For Payroll Malaysia Smart Touch Technology

The Dirty Secret Of Ote For Inside Sales Reps

Formul St Partners Plt Chartered Accountants Malaysia Facebook

Salary Calculation Dna Hr Capital Sdn Bhd

Calculating Ppp Adjustments For Djasom Pricing David J Anderson School Of Management

Should You Pay Your Overseas Employee A Us Salary

Complete Production Calculation Of Yarn Spinning

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Overtime Calculator For Payroll Malaysia Smart Touch Technology

How To Calculate Vacation Entitlement In Excel Youtube

Should You Pay Your Overseas Employee A Us Salary

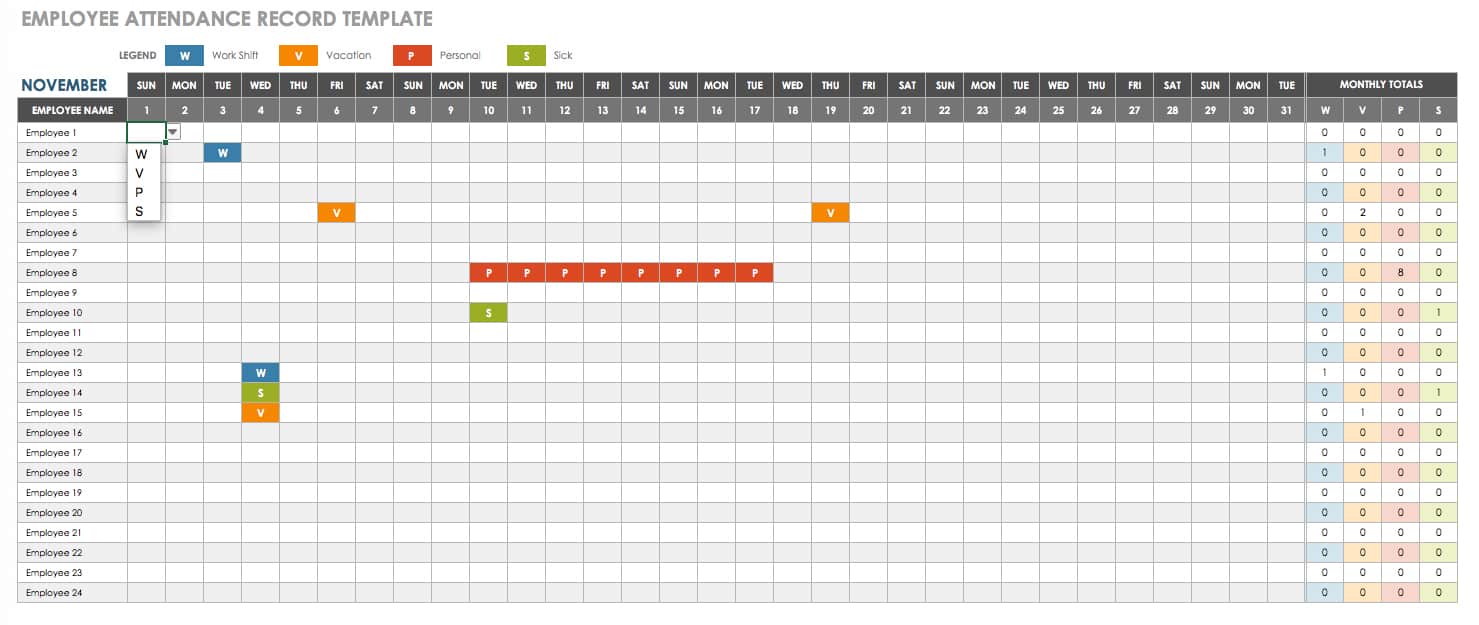

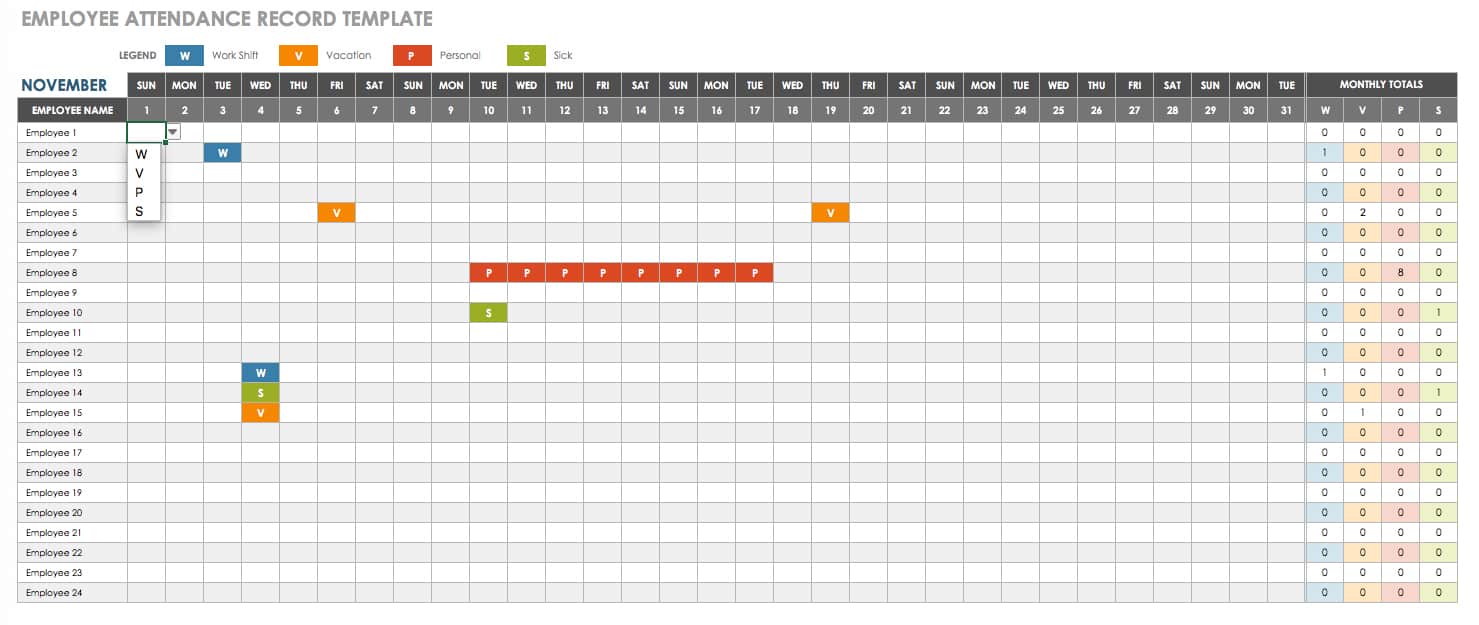

15 Free Payroll Templates Smartsheet

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Should You Pay Your Overseas Employee A Us Salary

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Should You Pay Your Overseas Employee A Us Salary